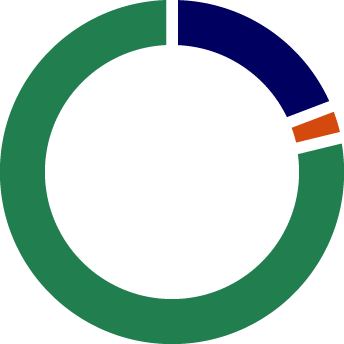

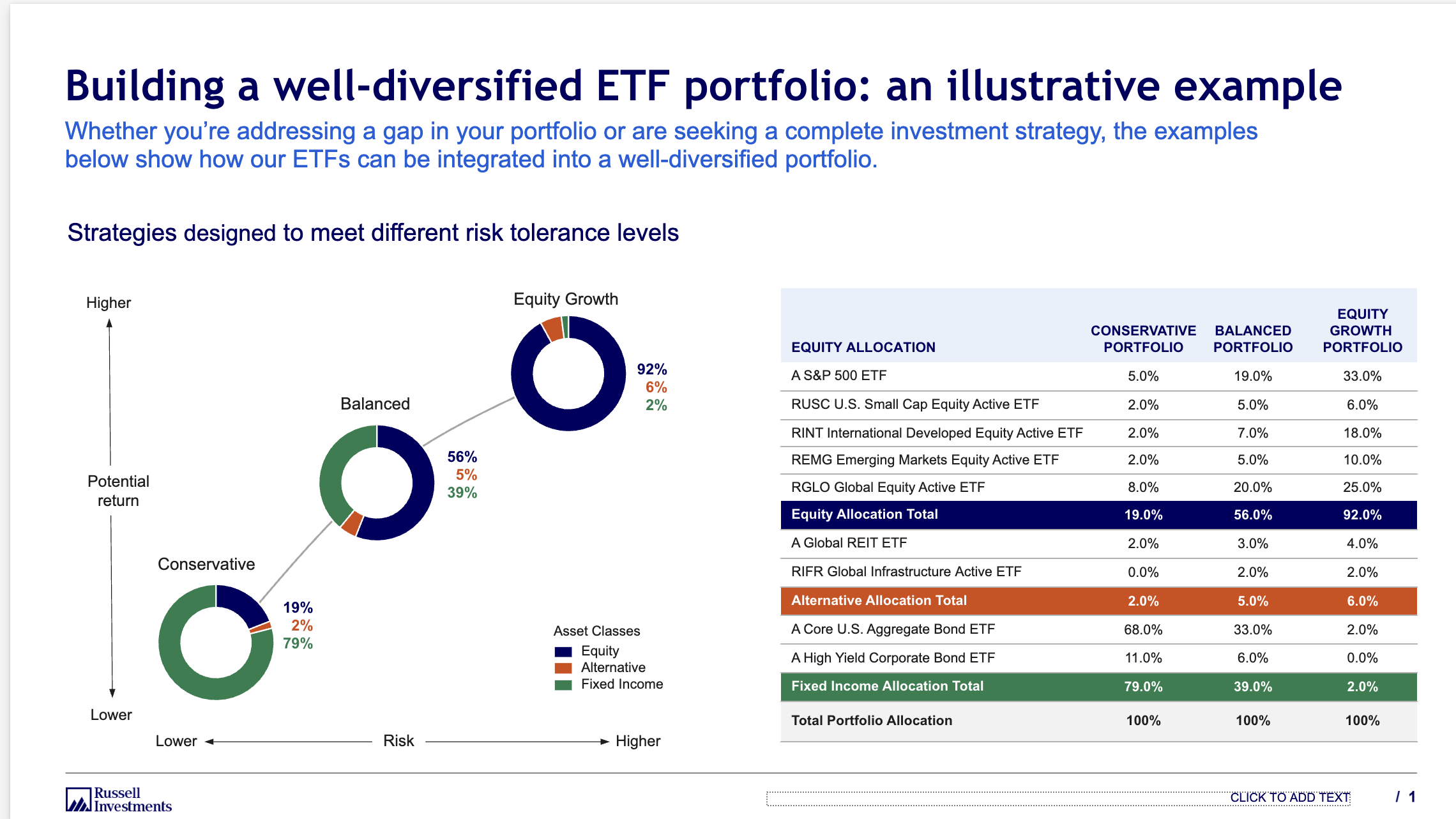

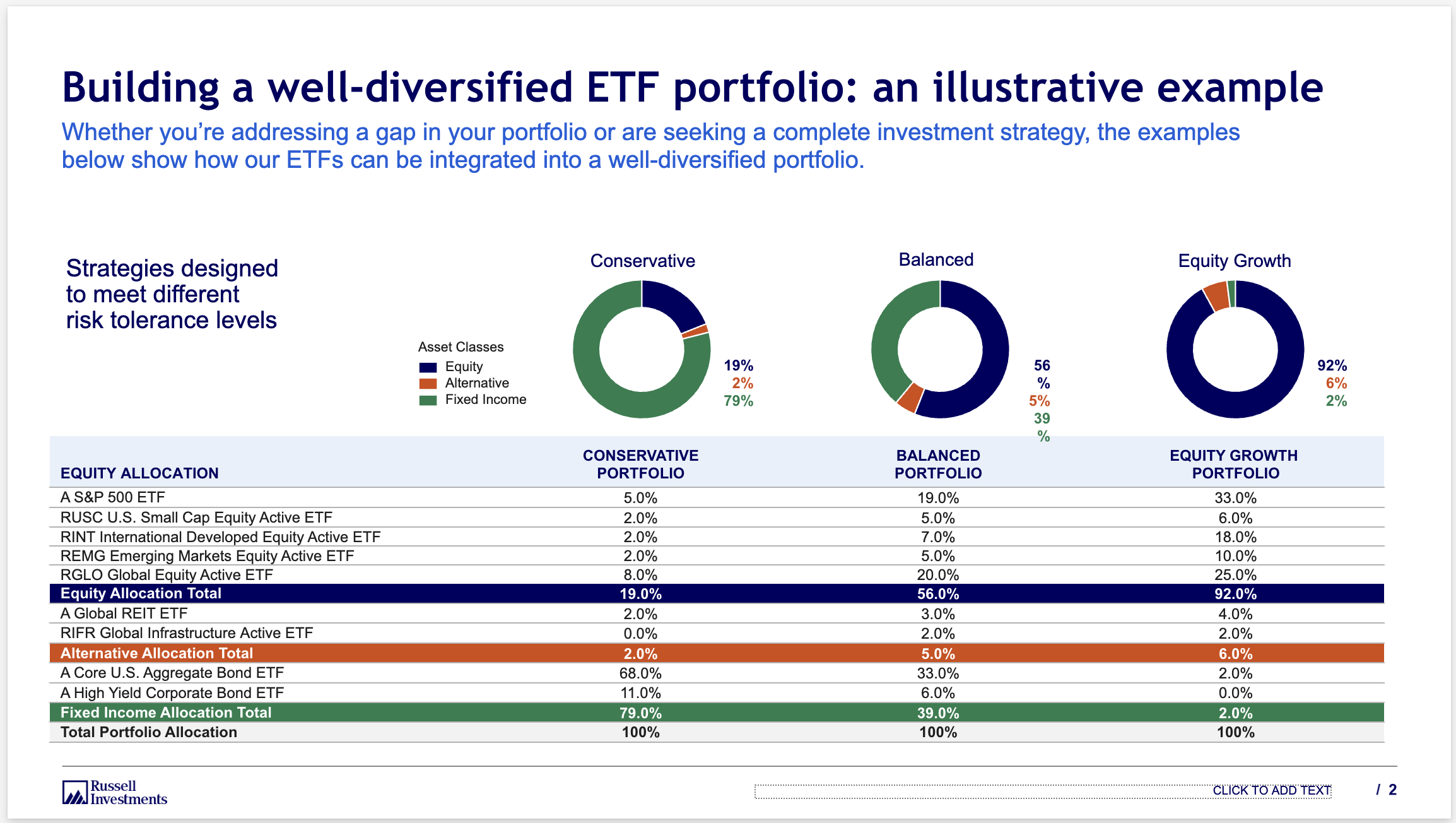

Conservative Portfolio

For investors seeking current income and capital preservation, and as a secondary objective, long-term capital appreciation.

Higher

Risk

Conservative

Balanced

19% equity | 2% alternative | 79% fixed income

balanced

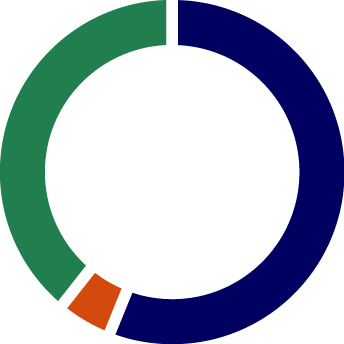

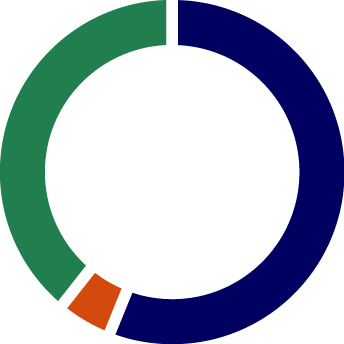

Balanced Portfolio

56% equity | 5% alternative | 39% fixed income

Equity growth

conservative

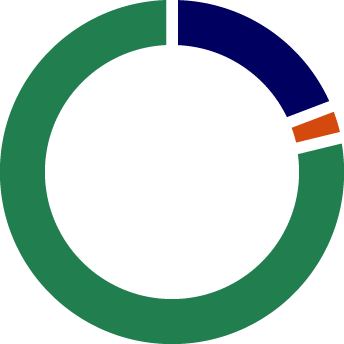

Equity Growth

Equity Growth Portfolio

Growth

balanced

Test for button

Your preferred U.S. large cap ETF

RUSC - RI U.S. Small Cap Equity ETF

RINT - RI International Developed Equity ETF

REMG - RI Emerging Markets Equity ETF

RGLO - RI Global Equity ETF

Equity allocation total

Your preferred global listed real estate ETF

RIFR - RI Global Infrastructure ETF

Alternative allocation total

Your preferred U.S. core bond ETF

Your preferred U.S. high yield bond ETF

Fixed income allocation total

39%

33%

6%

5%

3%

2%

56%

19%

5%

7%

5%

20%

Balanced

92% equity | 6% alternative | 2% fixed income

79%

68%

11%

2%

2%

0%

19%

5%

2%

2%

2%

8%

Conservative

2%

2%

0%

6%

4%

2%

92%

33%

6%

18%

10%

25%

Equity Growth

For investors seeking above-average long-term capital appreciation and a moderate level of current income.

For investors seeking high long-term capital appreciation, and as a secondary objective, current income.

Potential Return

Lower

Lower

Higher

Equity

Alternative

Fixed Income