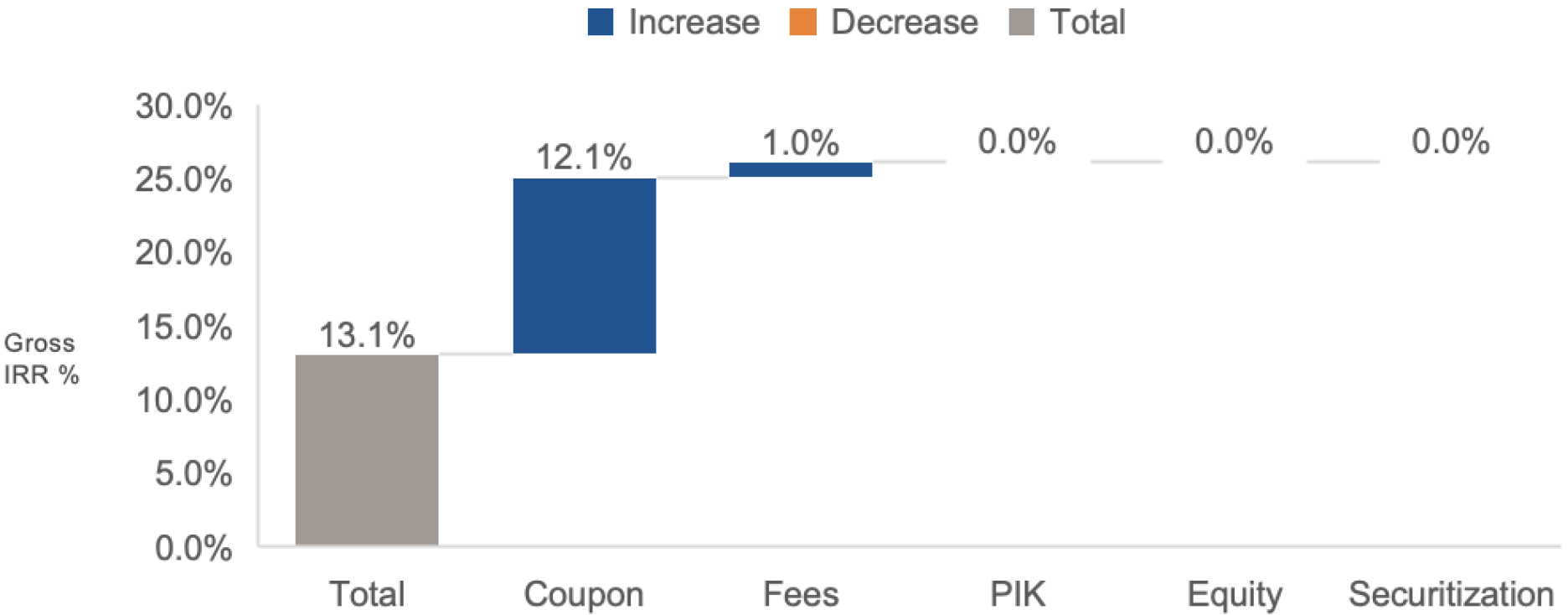

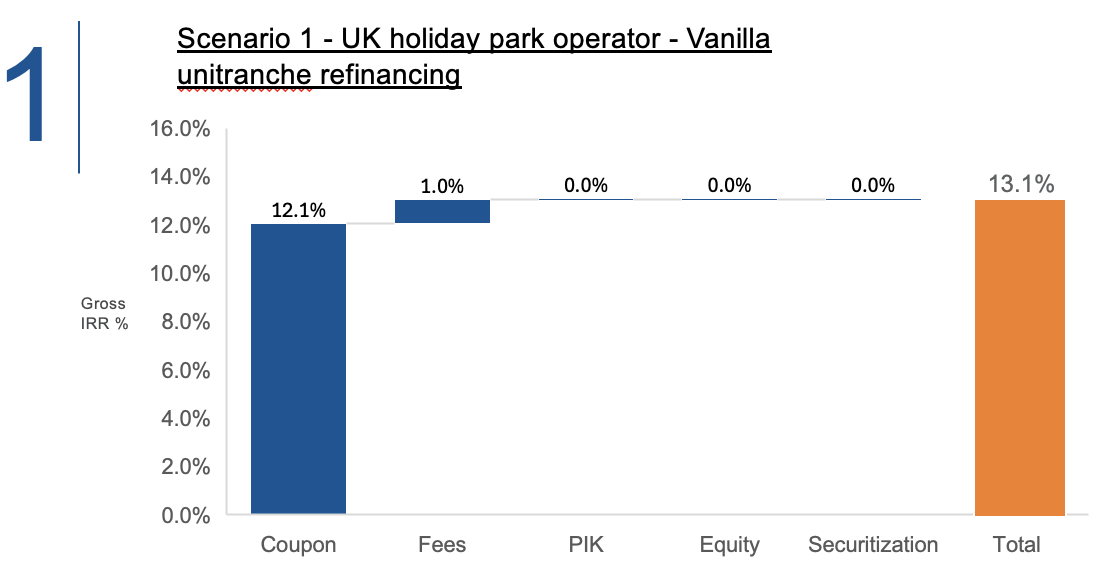

Scenario 1

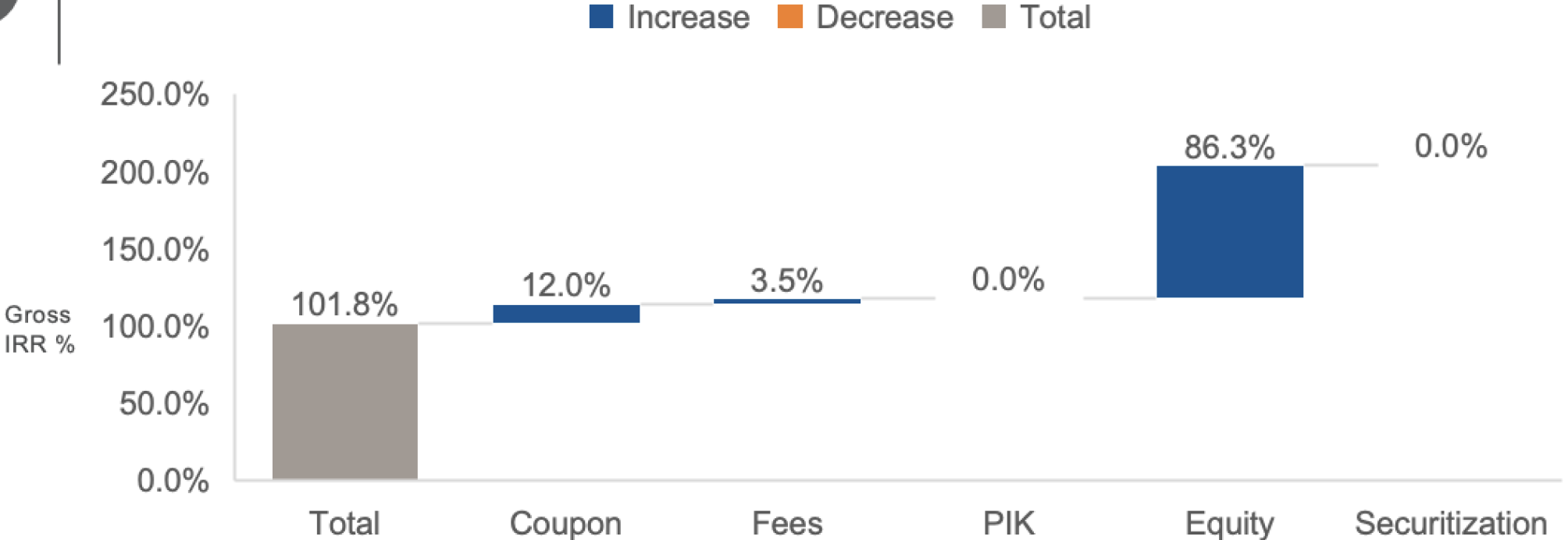

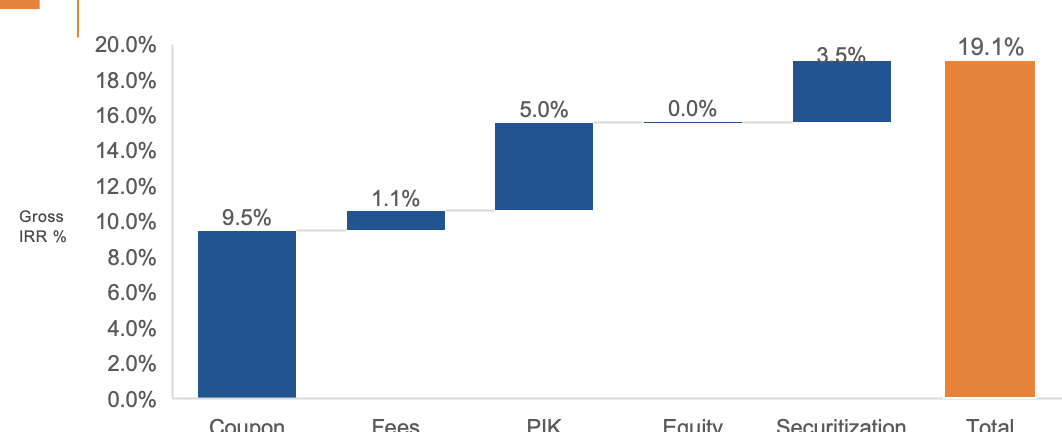

Scenario 2

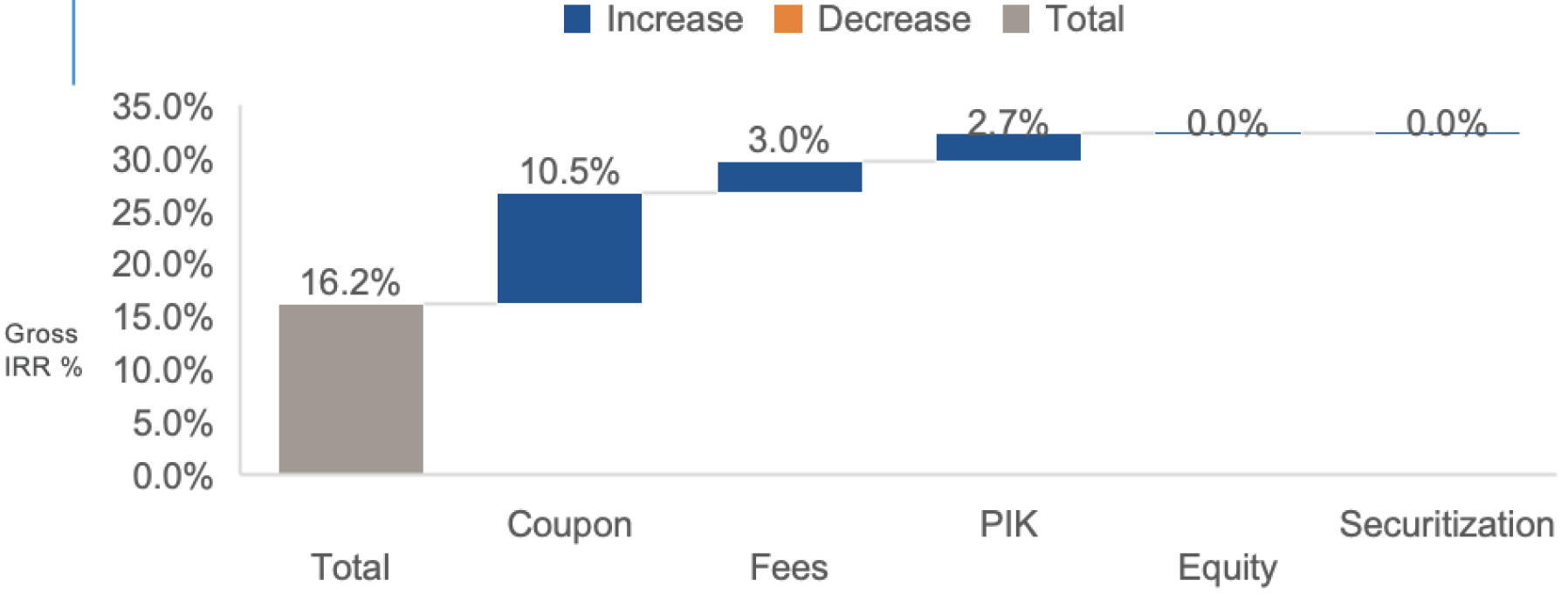

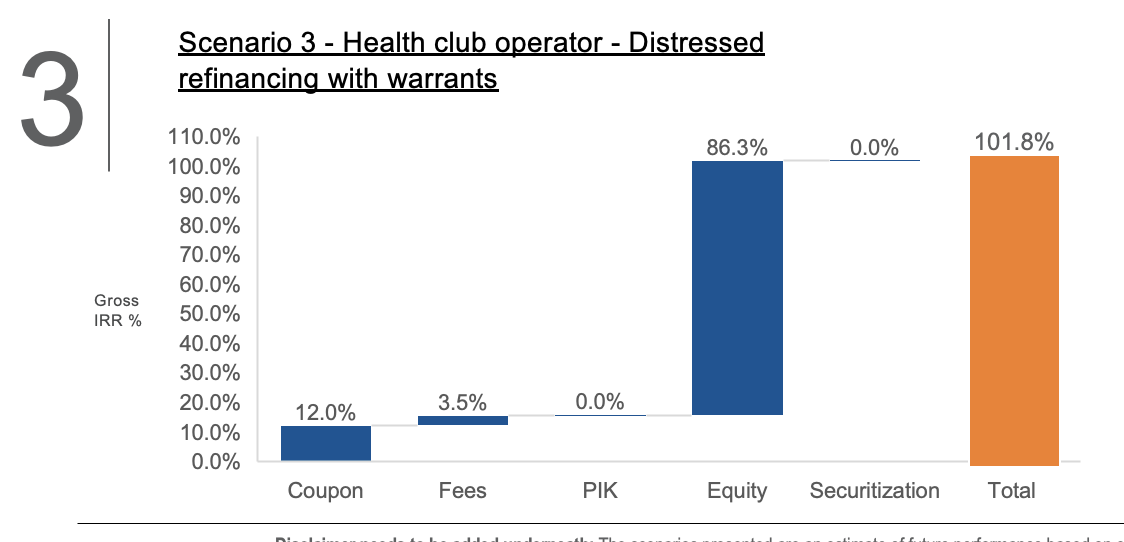

Scenario 3

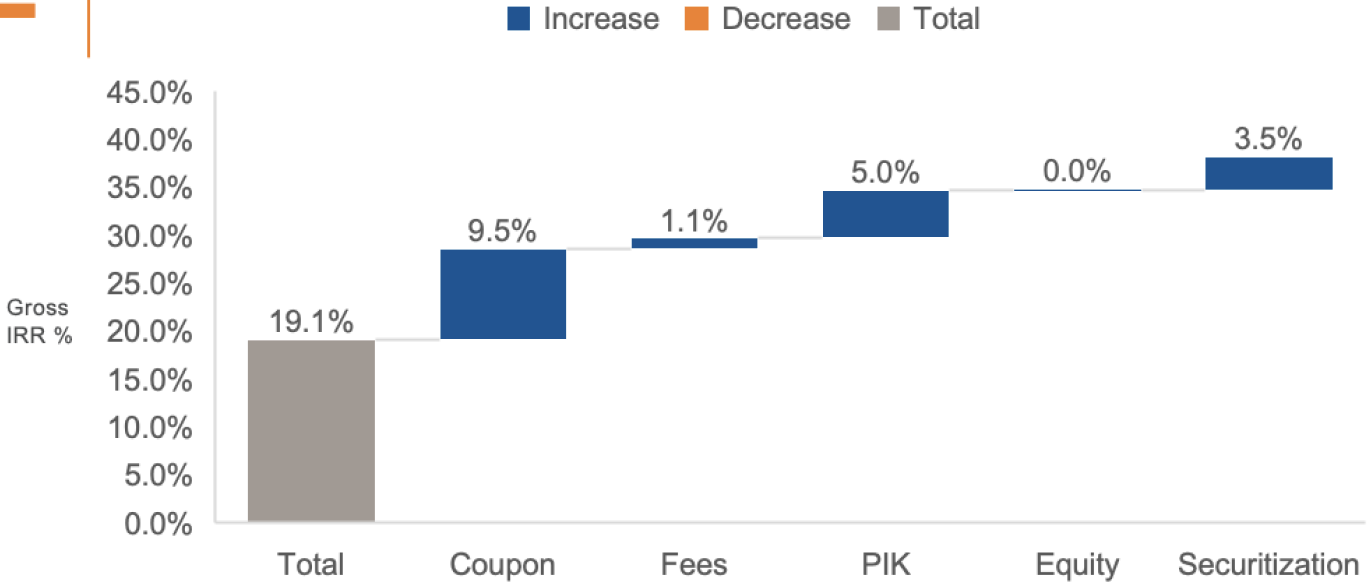

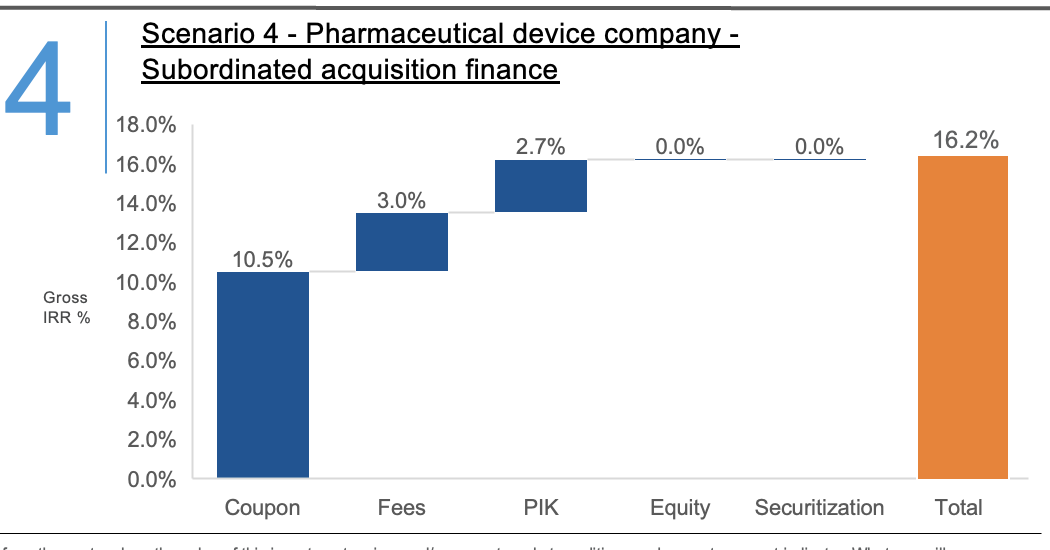

Scenario 4

14.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

Coupon

Fees

PIK

Equity

Securitization

Total

12.1%

1.0%

0.0%

0.0%

0.0%

13.1%

Gross IRR %

Increase

Total

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

9.5%

1.1%

5.0%

0.0%

3.5%

19.1%

12.0%

3.5%

0.0%

86.3%

0.0%

101.8%

10.5%

3.0%

2.7%

0.0%

0.0%

16.2%

110.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

12.0%

16.0%

14.0%

12.0%

16.0%

20.0%

18.0%

60.0%

70.0%

80.0%

90.0%

100.0%

12.0%

14.0%

18.0%

16.0%

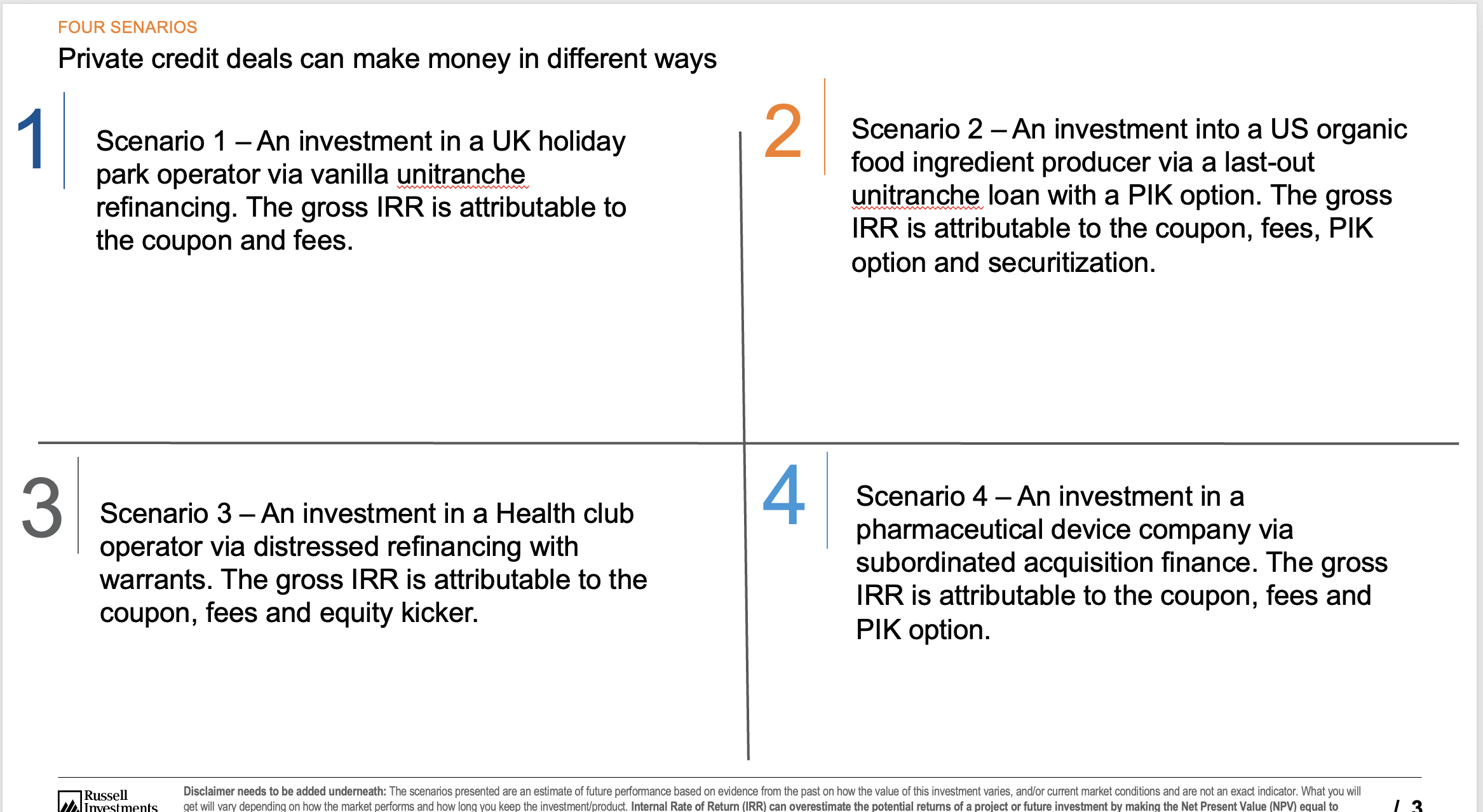

An investment in a UK holiday park operator via vanilla unitranche refinancing. The gross IRR is attributable to the coupon and fees.

An investment into a US organic food ingredient producer via a last-out unitranche loan with a PIK option. The gross IRR is attributable to the coupon, fees, PIK option and securitization.

An investment in a Health club operator via distressed refinancing with warrants. The gross IRR is attributable to the coupon, fees and equity kicker.

An investment in a pharmaceutical device company via subordinated acquisition finance. The gross IRR is attributable to the coupon, fees and PIK option.